The Enduring Legacy of Old Technologies in the Financial Services Industry

The Enduring Legacy of Old Technologies in the Financial Services Industry

The Enduring Legacy of Old Technologies in the Financial Services Industry

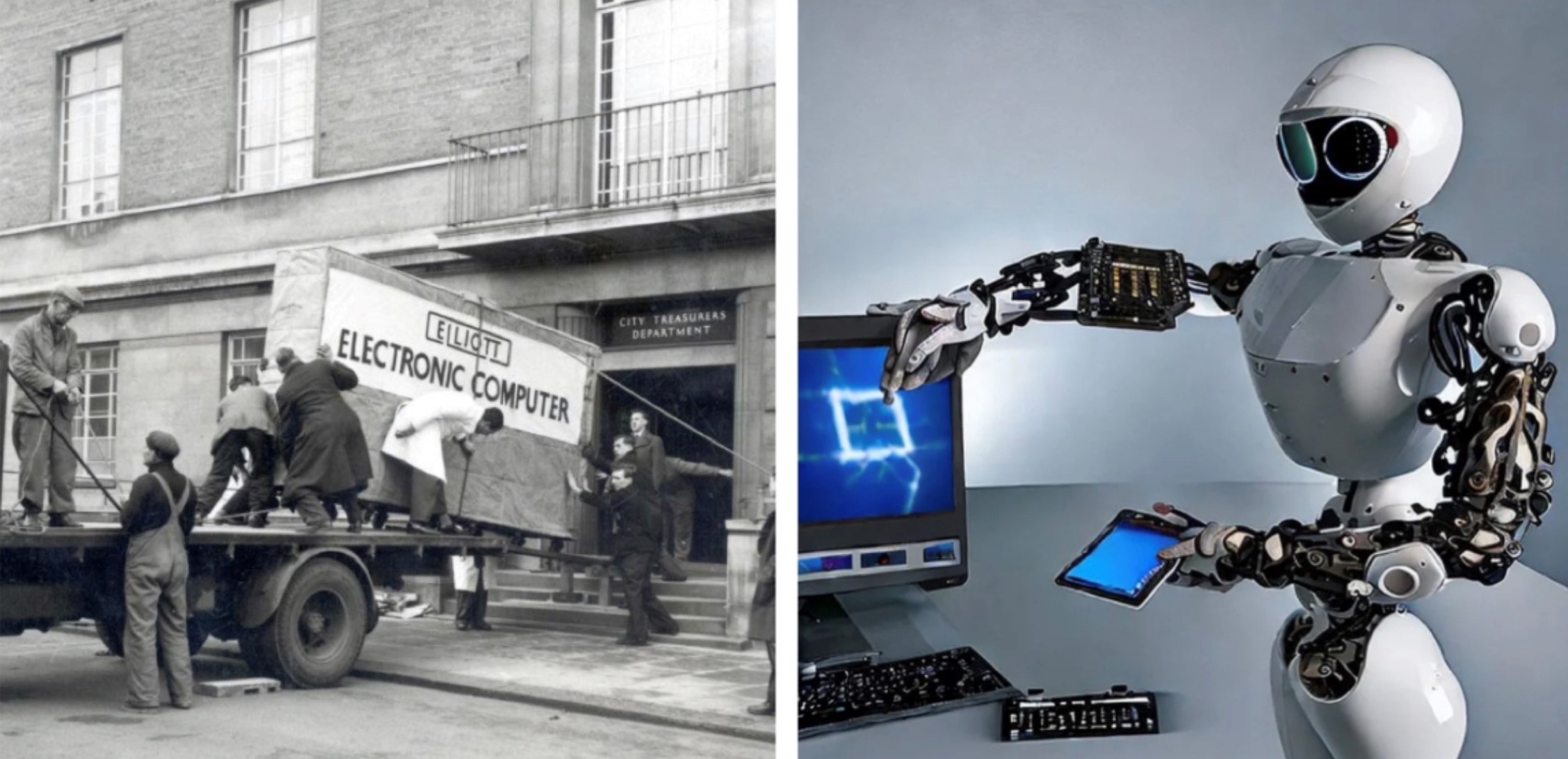

The financial services industry is often perceived as being at the forefront of technological innovation, with cutting-edge advancements in everything from artificial intelligence to blockchain. However, beneath the surface of these flashy new technologies lies a surprising reliance on old, established methods and systems. In fact, many of the technologies that underpin the modern financial world date back decades, and they continue to play a vital role in ensuring the stability and efficiency of global markets.

The Power of Legacy Systems

Legacy systems are software applications or infrastructure that have been in use for a significant period.

They may have been initially developed to meet the specific needs of a particular financial institution or industry, and they may have undergone significant upgrades and modifications over the years. Despite their age, legacy systems can be incredibly valuable assets. They often contain a wealth of historical data and insights that can be used to inform decision-making, and they can be highly reliable and efficient in their day-to-day operations.

Examples of Legacy Technologies in Financial Services

There are numerous examples of legacy technologies that continue to play a crucial role in the financial services industry. These include:

- Centralised mainframes: These powerful computing systems were developed in the 1950s and 1960s, and they remain the backbone of many financial institutions’ core banking systems. They are capable of handling vast amounts of data and transactions, and they are highly reliable and secure.

- Cobol programming language: Developed in the 1950s, Cobol is a procedural programming language that is still widely used in the financial industry. It is known for its efficiency and reliability, and it is particularly well-suited for processing large amounts of data.

- FTP (File Transfer Protocol): FTP is a standard protocol for transferring files between computers. It is commonly used in the financial industry to exchange data between different systems.

The Challenges of Legacy Systems

While legacy systems offer many advantages, they also pose challenges. These include:

- Maintenance: Legacy systems can be complex and difficult to maintain, requiring specialized expertise and resources.

- Security: Legacy systems may be vulnerable to cyberattacks, as they may lack the latest security features and patches.

- Scalability: Legacy systems may struggle to handle the growing volume and complexity of financial transactions.

The Future of Legacy Systems

As technology continues to evolve, the financial services industry is faced with the challenge of modernizing its legacy systems while preserving their functionality and stability. This requires a careful balance between innovation and risk management. Some financial institutions are opting to migrate their legacy systems to newer, more scalable platforms, while others are investing in upgrades and enhancements to extend the life of their legacy systems.

The future of legacy systems in the financial services industry is uncertain, but it is clear that they will continue to play a significant role for the foreseeable future. As the industry adapts to new challenges and opportunities, legacy systems will need to evolve alongside it, ensuring that the financial world remains stable and efficient despite the ever-changing technological landscape.